Mumbai: May 22, 2020 The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday slashed its key policy rates to stabilize the financial system and tackle the economic fallout from the ongoing nationwide lockdown to contain the spread of the coronavirus pandemic. The RBI panel unexpectedly cut the repo rate by 40 basis points to 4 per cent and the reverse repo rate by 40 basis points to 3.35 per cent. In another significant move, the RBI also announced extension of moratorium on loan repayments by another three months to August 31.

What will be the impact of rate cut?

The 40 bps cut in the repo rate – the interest rate that the RBI charges for funds given to banks – will make funds cheaper for banks thus aiding them to bring down lending rates. This comes at a time when credit offtake is sluggish and investments have halted in the economy. EMIs on home, auto, personal and term loan rates are expected to come down in the coming days.

However, banks will also slash deposit rates on various tenures to manage its asset-liability position. Savers and pensioners will see their returns coming down.

Further, the 40 bps cut in reverse repo rate — the interest rate that the RBI offers to banks for funds parked with the central bank — will prompt banks to make available funds for the productive sectors of the economy. Now, banks have been parking close to Rs 7-8 lakh crore at the RBI’s reverse repo window instead of lending these funds.

What’s the significance of extension of moratorium?

The RBI has now extended the moratorium on term loan repayment by another three months to August 31, 2020. On March 27, the RBI had announced a three month moratorium till May 31 (March 1-May 31). This will help borrowers, especially corporates which have halted production and are facing cash flow problems, to get more time to stabilize their operations and restart their units. All borrowers, including home loan, term loans and credit card outstandings, will get the benefit of the moratorium.

In another significant measure, the RBI has allowed borrowers and banks to convert the interest charges during the moratorium period (from March 1 to August 31) into a term loan which can be repaid by March 2021. This is expected to reduce the burden on borrowers who have gone for moratorium.

What the market expected and the RBI did not announce?

The RBI did not make any announcement on one-time restructuring of loans as relief measures to tackle the impact of lockdown and the slowdown in the economy due to the Covid pandemic. The banking sector and corporate made these suggestions to the RBI in the past few days. Bankers are still hopeful that one-time loan restructuring will be later allowed.

There is no indication on the bad bank proposal suggested by the Indian Banks Association (IBA) to tackle bad loans. Non-banking finance companies were expecting permission from the RBI for direct infusion from banks instead of banks investing in the debt securities of NBFCs. The RBI was silent on on easing of bad loan recognition norm from 90 days to 180 days.

Why did the RBI cut interest rates?

The MPC, which met ahead of its scheduled meeting, is of the view that the macroeconomic impact of the pandemic is turning out to be more severe than initially anticipated, and various sectors of the economy are experiencing acute stress. The impact of the shock has been compounded by the interaction of supply disruptions and demand compression. Beyond the destruction of economic and financial activity, livelihood and health are severely affected. Even as various measures initiated by the government and the Reserve Bank work to mitigate the adverse impact of the pandemic on the economy, it is necessary to ease financial conditions further. This will facilitate the flow of funds at affordable rates and revive animal spirits, the MPC says.

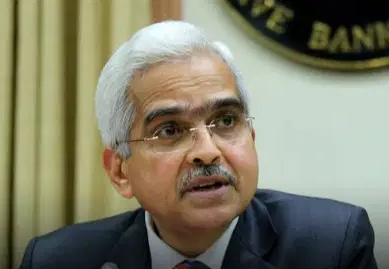

RBI Governor Shaktikanta Das said the growth is likely to be in the negative territory in 2020-21. However, he did not mention any specific figure on the growth rate. MPC said economic activity other than agriculture is likely to remain depressed in Q1 of 2020-21 in view of the extended lockdown. Even though the lockdown may be lifted by end-May with some restrictions, economic activity even in Q2 may remain subdued due to social distancing measures and the temporary shortage of labour. Recovery in economic activity is expected to begin in Q3 and gain momentum in Q4 as supply lines are gradually restored to normalcy and demand gradually revives.